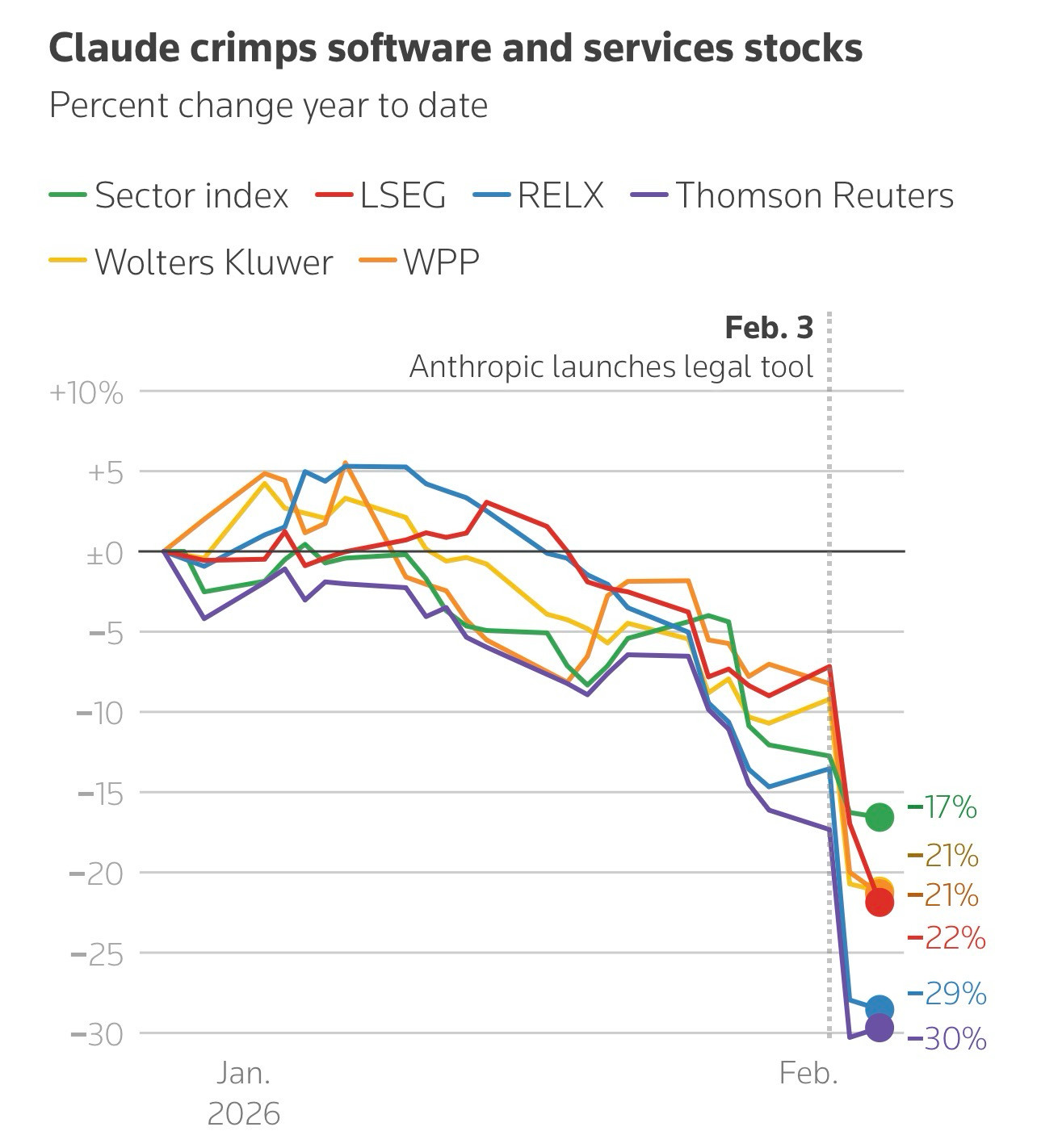

This has been a brutal week for software stocks and software geeks alike, as fears surrounding the potentially disruptive impact of artificial intelligence (AI) are fueling a significant selloff in global markets. The downturn was exacerbated by the introduction of a new automation tool from AI firm Anthropic, Claude Code, which prompted widespread investor anxiety regarding the viability of traditional software companies.

The new tool can easily build webpages, mobile apps and other once difficult to make software

Nvidia’s CEO Jensen Huang responded to these fears, labeling the stock decline as “illogical.” He asserted, “AI will use and amplify software tools — not replace them,” in the face of growing skepticism from investors worried about AI-driven disruption affecting established business models, particularly in financial and legal sectors.

The repercussions of the selloff are stark, with approximately $285 billion wiped from the market capitalization of software, financial services, and asset management stocks. Huang emphasized that AI’s potential does not entail the obsolescence of existing software, countering the narrative that has gripped Wall Street and other global markets.

Despite the turmoil, the FTSE 100 index hit a record high amidst a notable £8 billion insurance takeover, highlighting a divergence in the broader market landscape. However, this has done little to alleviate the pressure faced by software stocks, which have entered a second day of declines, leaving many dip-buyers absent from the field.

The latest market trends reflect a precarious situation for software billionaires, who have reportedly seen their collective fortunes plummet by at least $62 billion this year. As the sector grapples with the challenges posed by rapid advancements in AI technology, the global financial community continues to analyze the broader implications for investment strategies.

As of February 4, 2026, both U.S. and European software stocks are struggling to gain traction, exacerbated by concerns over how AI innovations may upend their long-standing business models.