Currently, VP’s the world over are shwoing graphs in Excel or Google sheet where they balance out the cost of employees and the cost of GPU’s compute time.

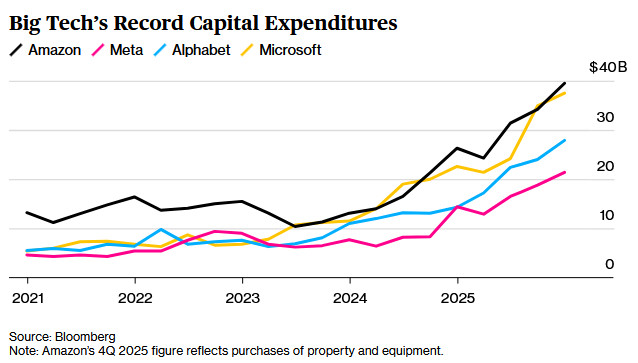

Four major U.S. technology companies, including Amazon, Google, Meta, and Microsoft, have collectively projected capital expenditures of approximately $650 billion for 2026, reflecting a remarkable increase in investment prioritizing artificial intelligence (AI) infrastructure. This anticipated spending represents roughly a 62% jump from the $388 billion recorded in 2025, according to market analysts and company disclosures.

In a substantial quarterly earnings announcement on February 5, Amazon projected a staggering $200 billion in capital expenditures for the coming year, a forecast that surpassed analyst expectations by over $50 billion. The announcement, however, resulted in an 11.5% drop in the company’s shares during after-hours trading, highlighting investor apprehension regarding the viability of such heavy capital flows. This could definitely explain the need to jettison as many employees as possible before earnings!

Big Tech’s ‘breathtaking’ $660bn spending spree reignites AI bubble fears, for sure.. the market reacted strongly to these financial forecasts. The concerns primarily center around the notion that the significant capital outlays may exceed the potential earnings generation from the new technology, leading to fears of a “tech-stock swoon.”

Microsoft’s influence on this spending trend cannot be underestimated, given that its Azure segment accounts for about 40% of its revenue. An analyst expressed concerns regarding OpenAI’s ability to fulfill its financial obligations, suggesting that if capital expenditures associated with Azure falter, it could lead to an 8% to 10% revenue loss for Microsoft.

Google’s planned expenditures in data center facilities for AI are expected to overshadow some of the largest U.S. companies from various sectors combined, raising eyebrows over the sustainability of such high spending levels. This trajectory has spurred debate among tech executives and analysts, with many suggesting that current investments into AI-driven infrastructure might be outpacing the prospective economic benefits.

The tech industry is bracing for a dynamic realignment as companies gear up to meet the dual challenge of expanding infrastructure while also addressing investor fears about potential returns.

As one analyst pointedly remarked, “Without Big Tech spending big money on hyperscalers, the U.S. economy would be contracting.” The unfolding dynamic between capital expenditure trends and stock market performance will likely continue to be a focal point for both investors and policymakers as 2026 approaches.