As if the panic associated with Covid19 – the precise name for the Corona Virus – were not sowing enough volatility into the market, now Russia’s split with the rest of OPEC will see increased downward movement in all major stock indices. The Putin government has decided to withdraw from a reduction of oil output agreement that would mostly benefit US shale oil producers, Maintaining a steady output or even flood the market would lead to lower oil barrel prices, magnifying the current loss of inflation and activity in the global markets.

Recession, Equity Will Face Pressure

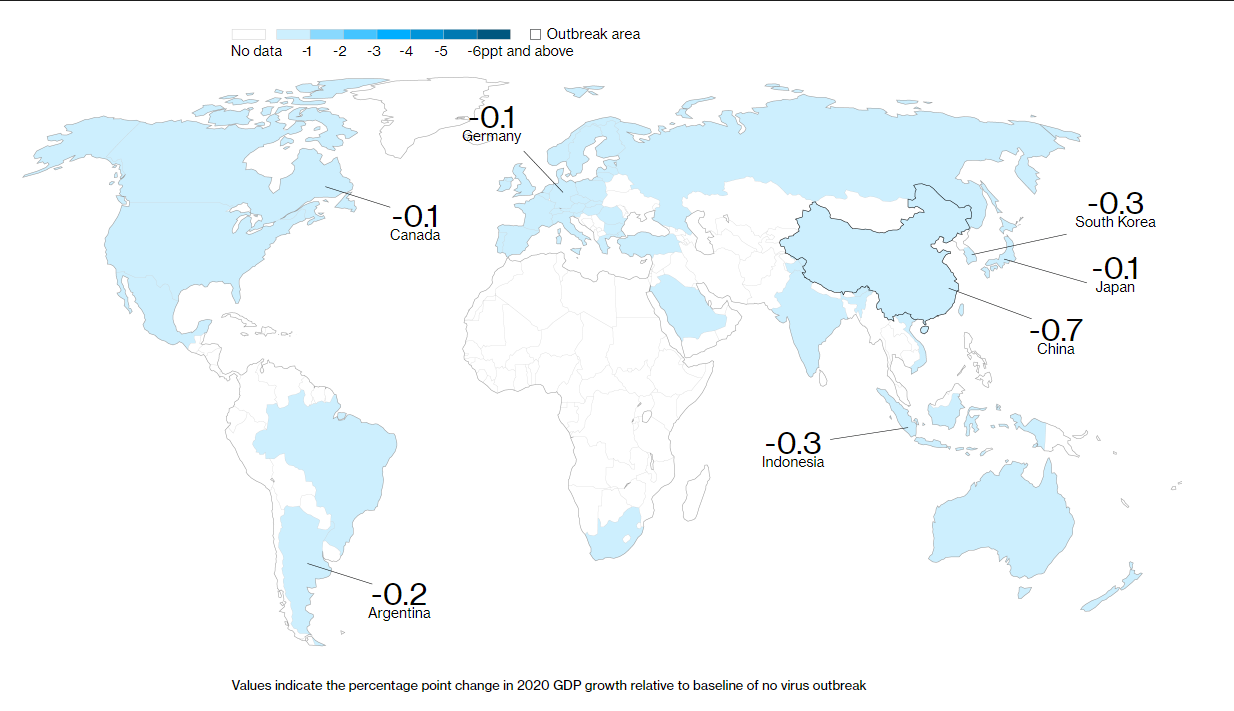

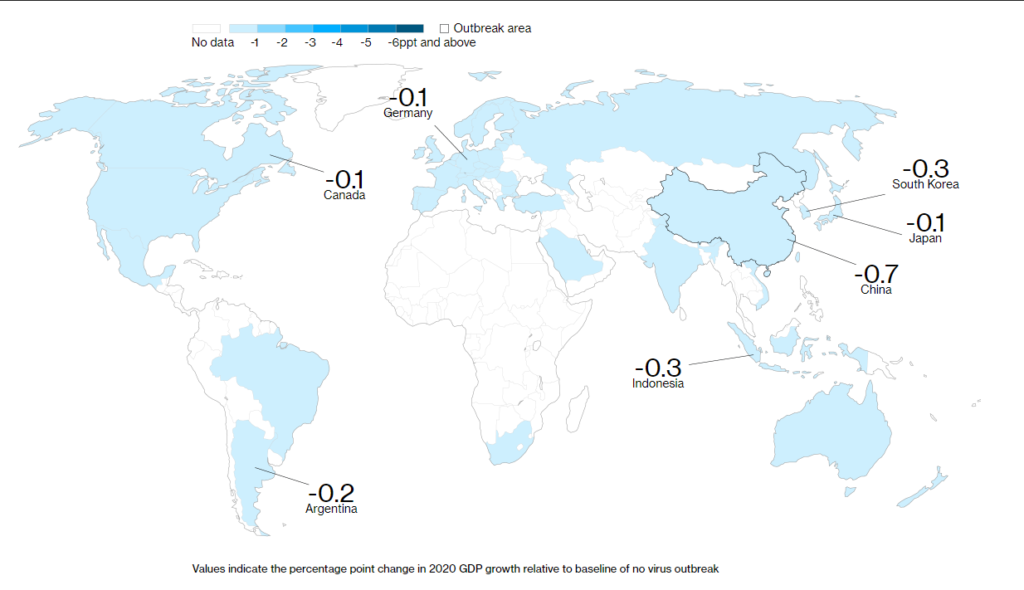

According to Bloomberg News, the total eventual growth in terms of GDP will contract globally e.g. triggering a technical recession. The impact of the virus will likely be felt in quarterly earnings reports for 1q of 2020, which should lead to more downward pressure on equity values.

Regardless of what the actual outcome turns out to be, one thing is certain: the ability for the world’s governments to both cope with the coronavirus and deal with its health and economic effects will define the rest of the year of 2020.